São Paulo City Hall publishes Municipal Law No. 10,095/2024 establishing the Incentive Installment Program (PPI 2024)

Summary

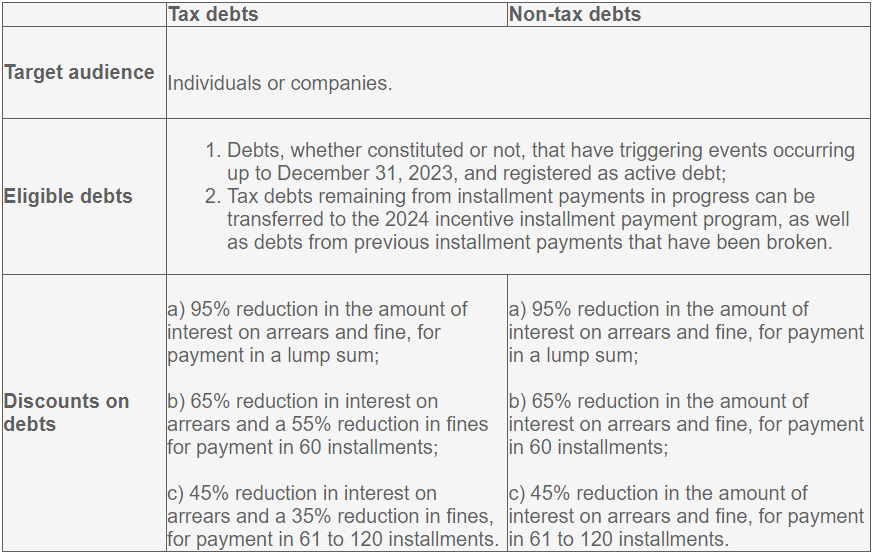

On March 19th, 2024, Municipal Law No. 10,095/2024 was published, establishing the Incentive Installment Program (PPI) in the City of São Paulo. This program allows for the settlement of tax or non-tax debts with reduced fines and interest.

The PPI is pending regulations to take effect.

The law also includes changes to legislation in accordance with Constitutional Amendment No. 132/2023, which modified the National Tax System and implemented measures to resolve disputes between tax authorities and taxpayers outside of the judicial system.

More details

Below is a brief summary of the benefits of regulating PPI 2024 in the Municipality of São Paulo: Tax and non-tax debts are eligible for individuals or companies:

In addition, the law introduced changes regarding interest on overdue debts. The interest rate is now based on the Selic rate, which accrues monthly and is charged only once, starting from the first day of the month following the due date. A 1% penalty is applied in the month in which the payment is made.

Regarding the adaptation of legislation to EC 132/2023, which pertains to tax reform, the legislation addresses issues related to setting ISS rates, allocating FEMATF resources, adjusting the Municipal Tax Council (CMT), and other changes.