Internal Revenue Services publishes public notice for special settlement agreement of tax debts in administrative litigation

In brief

On 03/19/2024, the Public Notice of special settlement agreement No.1/2024 was published, which provides for the opening of the Zero Litigation Program 2024, a new special settlement agreement for tax debts in administrative litigation within the scope of the IRS of Brazil, the value of which, per litigation, is up to R$ 50,000,000.00.

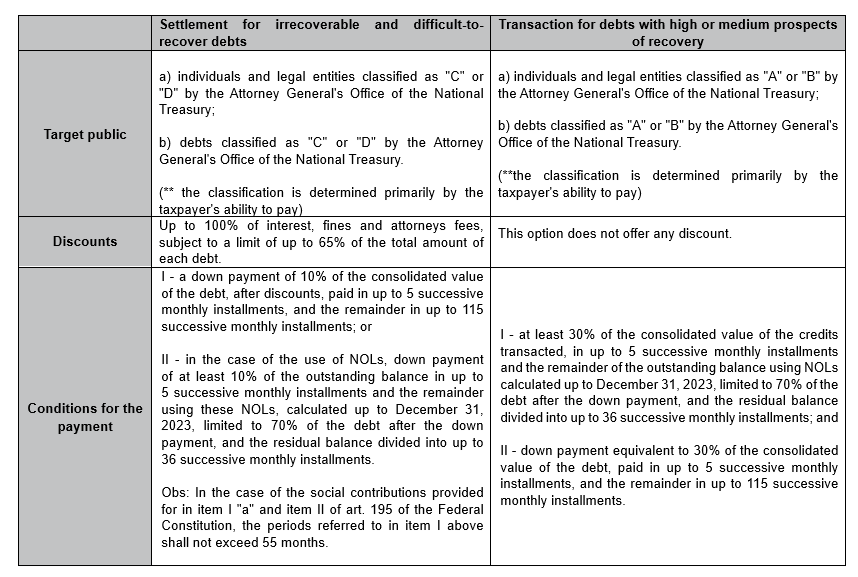

Discounts and payment terms will be determined according to the degree of recoverability of the debts.

The deadline for joining the Program is 04/01/2024 to 07/31/2024.

Details

The main features of the Public Notice are as follows:

- Deadline: from 04/01/2024 to 07/31/2024.

- Eligible debts: debts under administrative review by the IRS, relating to taxes administered by the IRS, including the social contributions referred to in subparagraphs “a”, “b” and “c” of the sole paragraph of art. 11 of Law No. 8.212/1991, the contributions instituted by way of substitution and the contributions due by law to third parties and collected by means of DARF, the value of which, per dispute, is up to R$ 50,000,000.00.

- Modalities contained in the Public Notice*: