Federal Treasury Department publishes public notice for special settlement agreement of debts in administrative or judicial litigation related to goodwill deductions

In brief

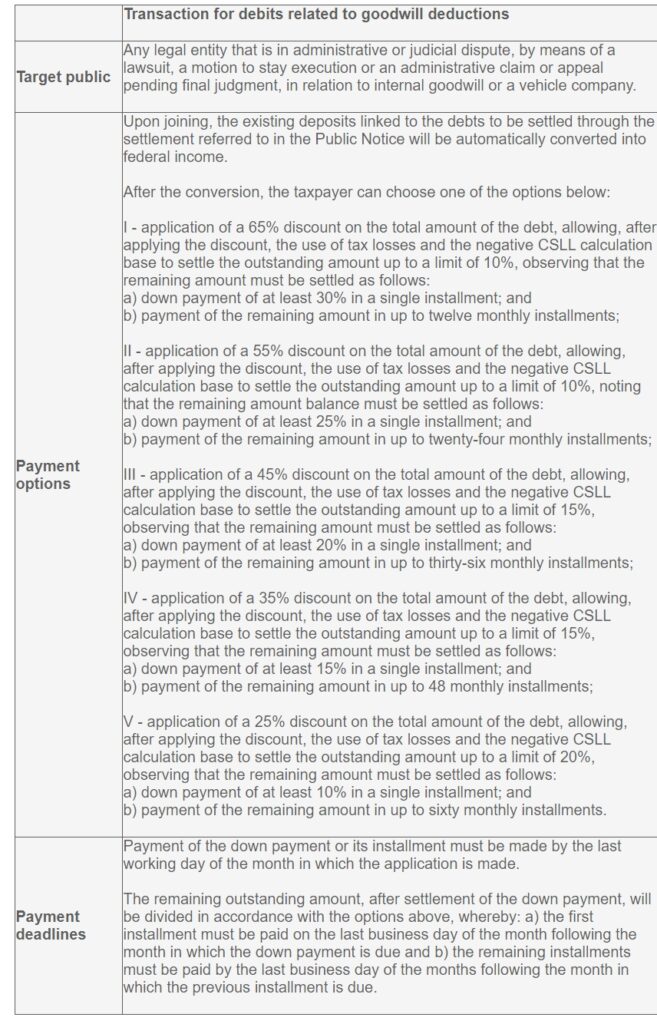

On 31 December, 2024 the Public Notice of special settlement agreement No. 24/2024 was published, which provides a new special settlement agreement for tax debts in administrative or judicial litigation related to tax goodwill deductions generated in corporate restructuring within the group itself (internal goodwill) and through a company set up solely to enable the amortization (vehicle company) of any amount.

Discounts and payment terms will be determined according to one of the five options set out in the Public Notice.

The deadline for joining the Program is 2 January, 2025 to 30 June, 2025.

In more detail

The main features of the Public Notice are as follows:

- Deadline: from 2 January, 2025 to 30 June, 2025.

- Eligible debts: debts registered as outstanding debt with the Federal Treasury Department, lawsuits or administrative appeals pending final judgment, in relation to (i) the deduction of goodwill generated in corporate restructuring within the group itself (internal goodwill) through abusive tax planning, in accordance with articles 7 and 8 of Law 9.532/97, in the period before Provisional Measure 627/13 came into force or (ii) the deduction of tax goodwill through a company set up solely to enable amortization (vehicle company) through abusive tax planning, in accordance with articles 7 and 8 of Law 9.532/97, including the fines related to the above disputes, including qualified fines.

- Modalities contained in the Public Notice: