Brazil: The Federal Treasury Department and Internal Revenue Services have published public notices for special settlement agreement of tax debts in litigation

24/05/2024

In brief

In May 2024, three public notices were published for the special settlement agreement of tax debts, as follows:

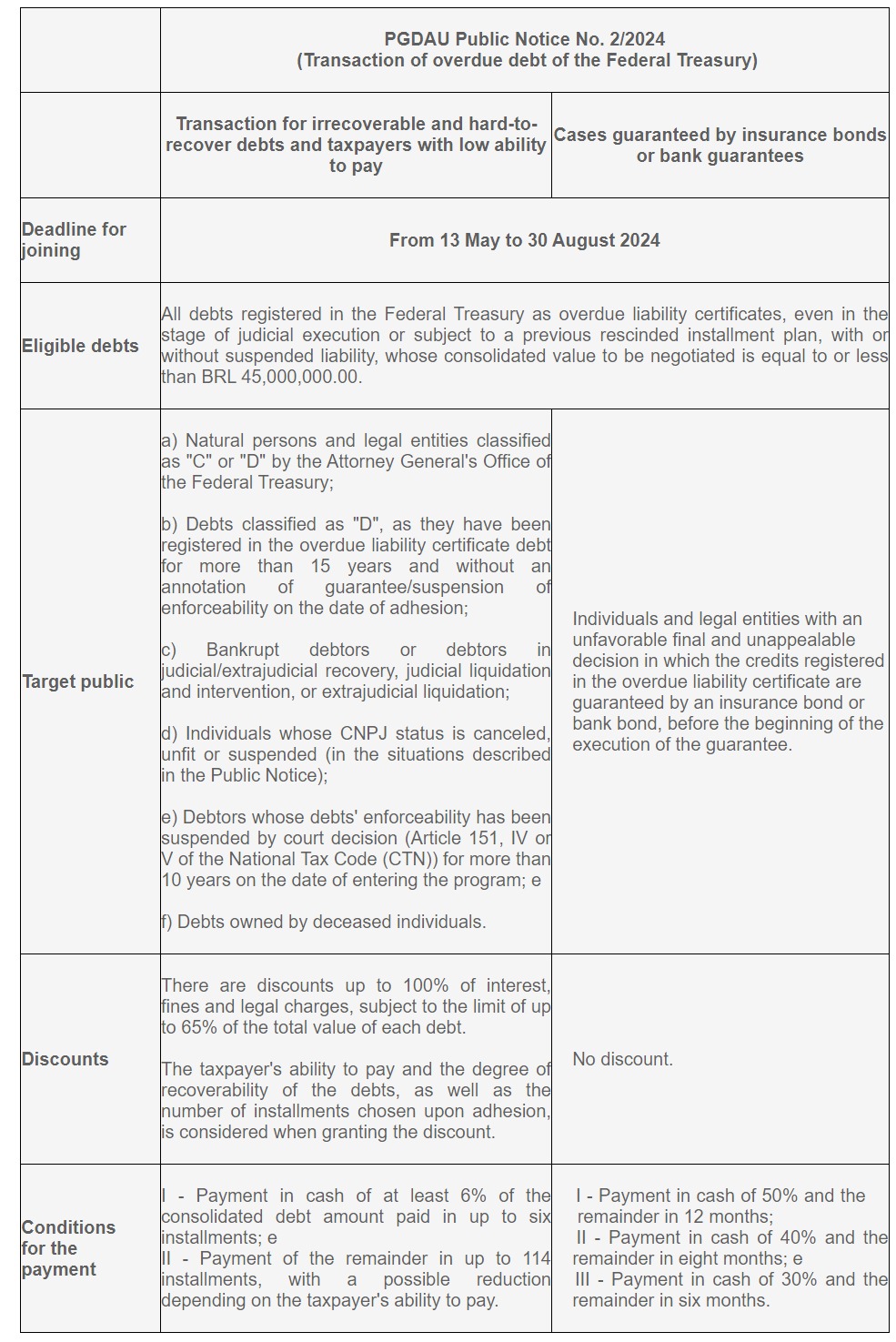

- PGDAU Public Notice No. 2/2024: It is intended for debts registered as overdue debt of the Federal Treasury, with a possible discount for those classified as irrecoverable and difficult to recover (CAPAG C or D) or an installment payment of the debt for cases guaranteed by insurance bonds or bank guarantees (CAPAG A or B).

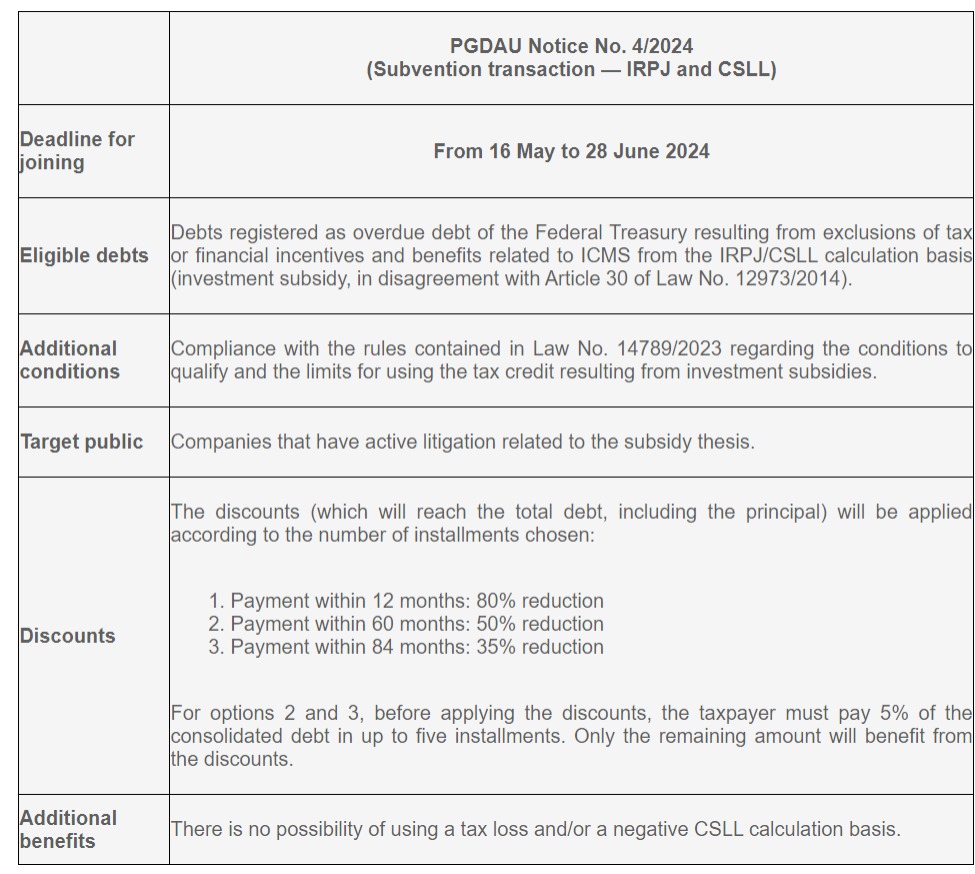

- PGDAU Public Notice No. 4/2024: It regulates Article 13 of Law No. 14789/2023, which provides for the transaction to encourage companies to pay IRPJ and CSLL (corporate income taxes), resulting from the exclusion of investment subsidies made in disagreement with Article 30 of Law No. 12973 of 13 May 2014. The transaction refers only to debts registered as overdue debt of the Federal Treasury.

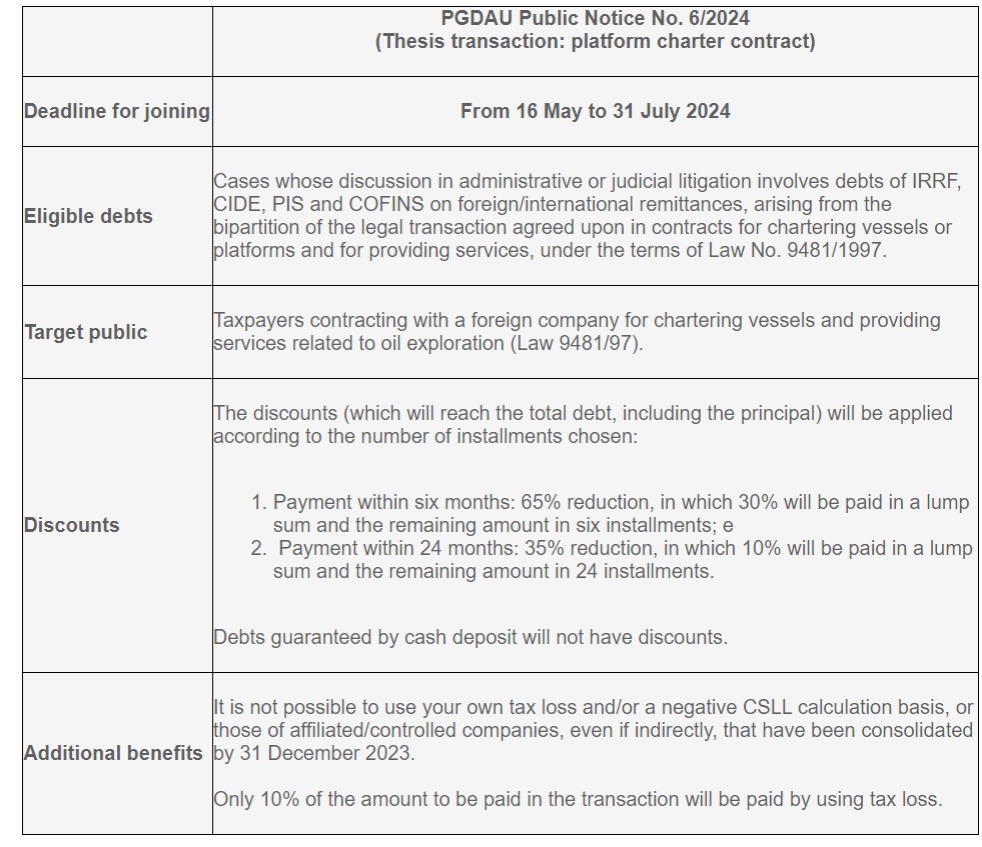

- PGDAU Public Notice No. 6/2024: It provides for a transaction to pay IRRF, CIDE, PIS and COFINS debts levied on foreign/international remittances, arising from the bipartition of the legal transaction agreed upon in contracts for chartering vessels or platforms and for providing services related to the exploration, development and production of oil and gas.

More details

1. PGDAU Public Notice No. 2/2024

2.PGDAU Public Notice No 4/2024

3. PGDAU Public Notice No 6/2024

Share on Social Media