Brazil: Tax Reform approved by the Congress

In summary

On December 16, 2023, the House of Representatives approved the bill of the Tax Reform, based on PEC 45 (Constitutional Amendment), in the final round after the Senate’s approval.

See below a summary of the matters that were included by the Senate, but were excluded by the House of Representatives from the final version approved:

- “Sin Tax” (IS) and CIDE: Suppresses the creation of the CIDE and maintains the IPI to guarantee the competitiveness of the ZFM (Manaus Free Tax Zone). IS no longer has an exclusive extra-fiscal (non-collective) attribute.

- Federative Council: Eliminates the need for approval by the president of the Federal Senate.

- Distribution of IBS: Suppresses the period for measuring collection for IBS distribution, which would be between 2024 and 2028, leaving the topic to be defined by Supplementary Law.

- ZFM Benefits: Removes benefits when importing petroleum derivatives into the ZFM.

- Differentiated regimes: Reduces the sectors with reduced rates to 18 and the sectors with differentiated regimes to 6. Specifically, sanitation and roads concession services are no longer included in this list; air transport services; operations that involve the provision of the shared structure of telecommunications services, goods and services that promote the circular economy; operations with microgeneration and distributed minigeneration of electrical energy. Furthermore, it suppresses the device that creates the extended basic meal basket and the exemption of medicine for public administration.

- Economic studies: Eliminates the need to publish studies and opinions with economic and financial impact for tax changes.

- Regulation: Suppresses the institution of IBS and CBS by the same Complementary Law.

- Hydrogen: Exchange “green” for “low carbon emissions” for the purpose of differentiated treatment

The final wording of the Constitutional Amendment is expected to be enacted until December 22,2023. The next step is the discussion of the Supplementary Laws with the practical details of the new system, which should be done by the Congress in the first semester of 2024. The Executive Power must also send, within 90 days, bills of Law related to the reforms of the income tax taxation and payroll taxation.

More details

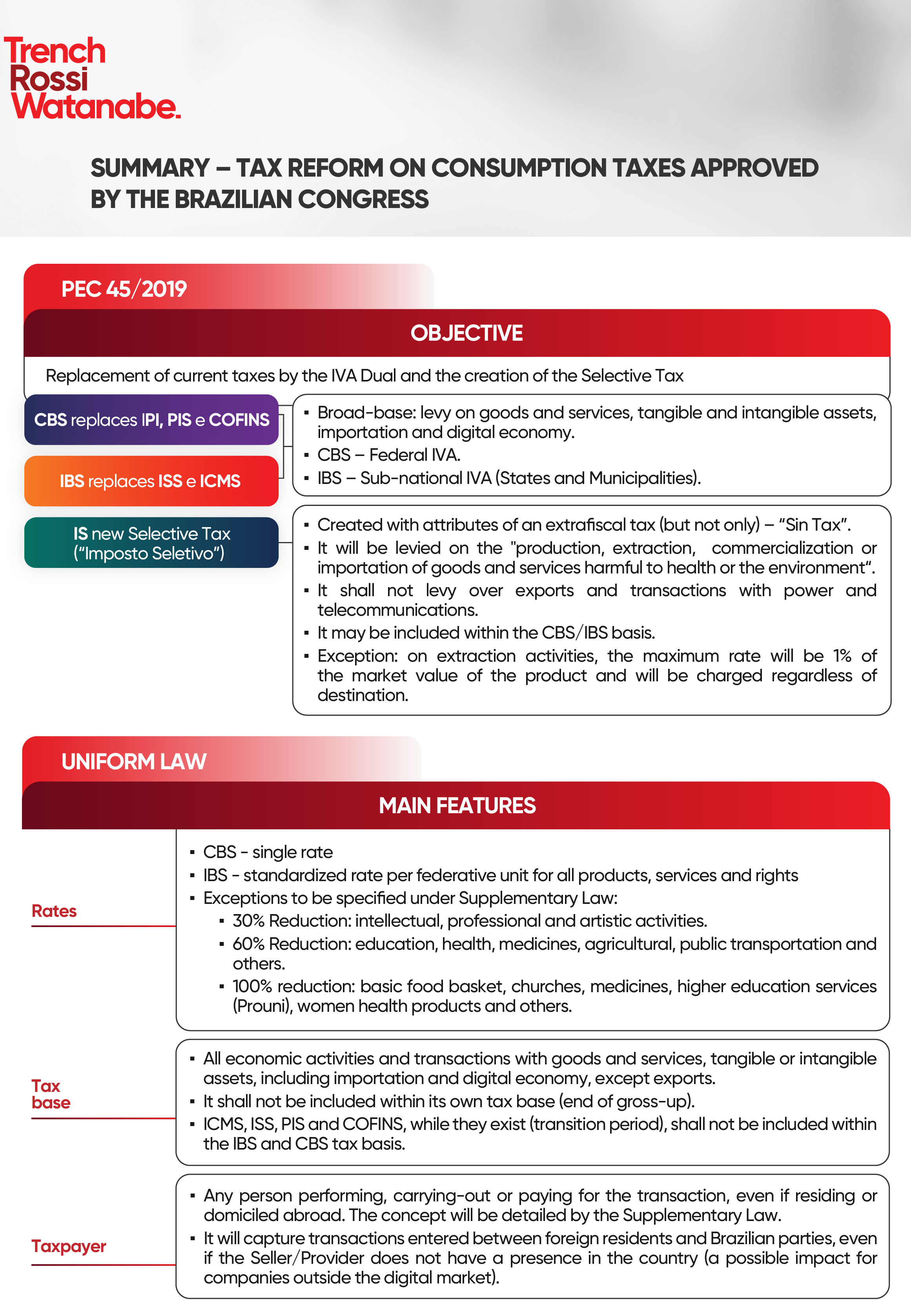

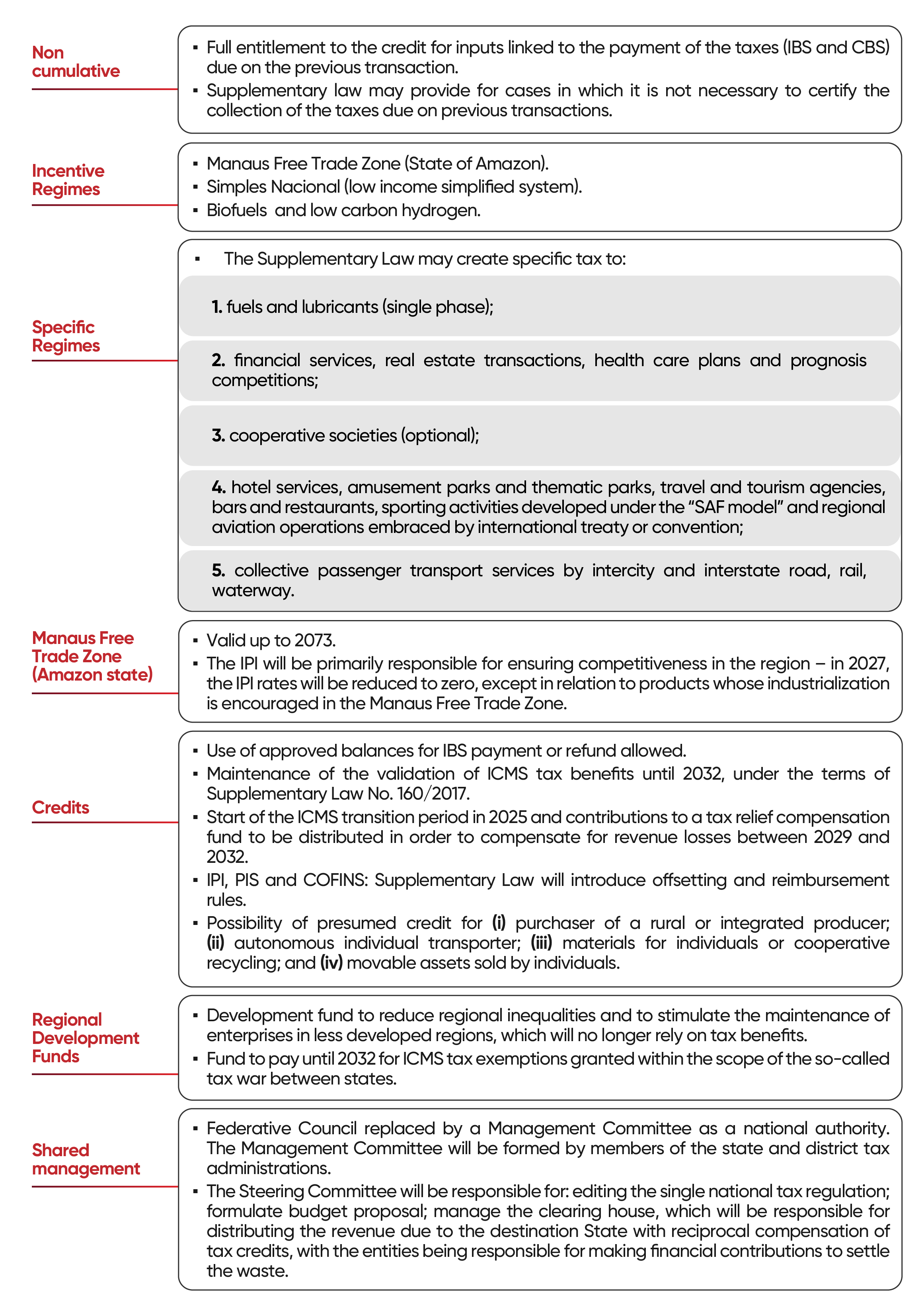

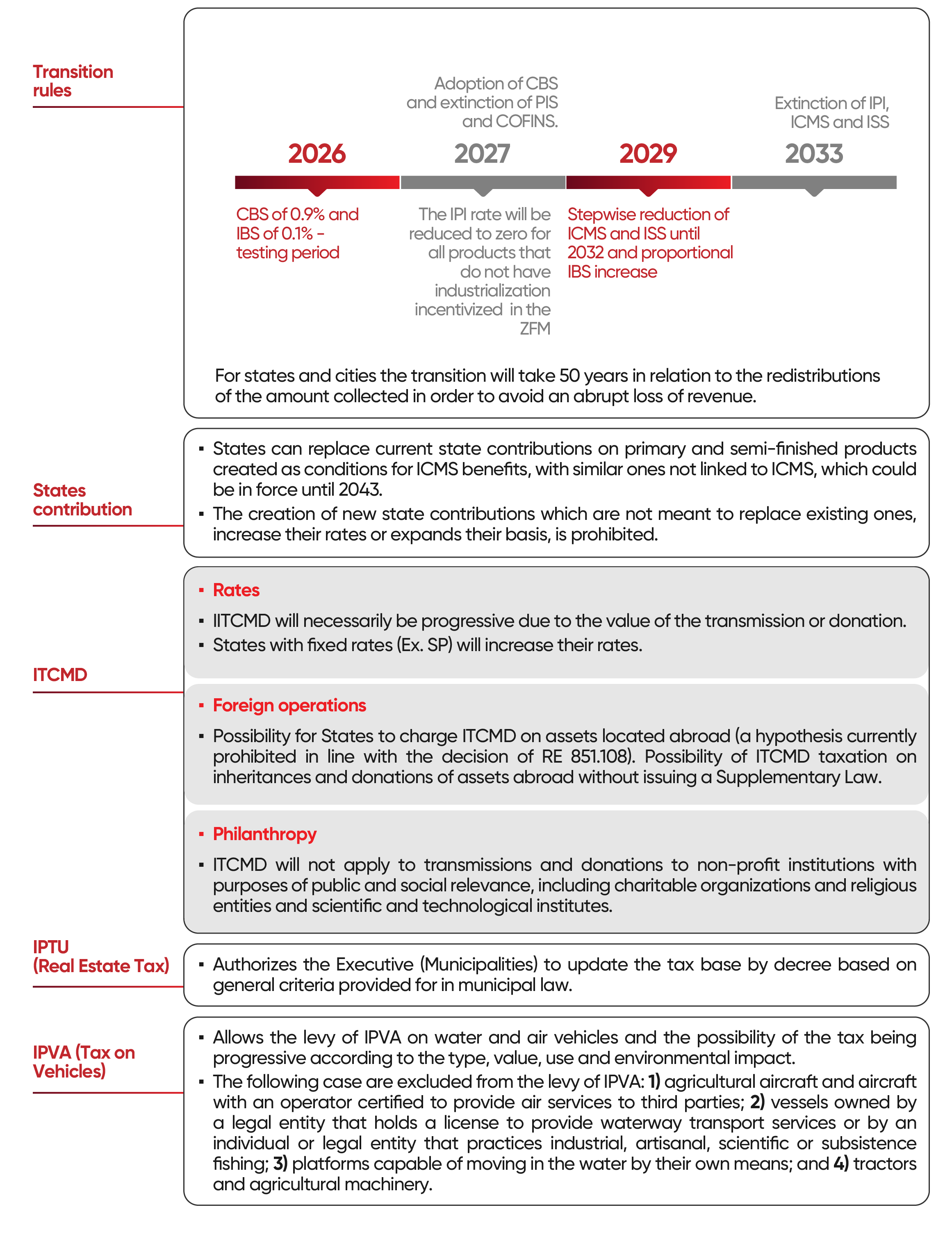

See below the infographic regarding the complete wording of the PEC 45 prepared by our Tax team on the subject.