Federal law published for self-regularization of debts with the Brazilian Internal Revenue Service

In brief

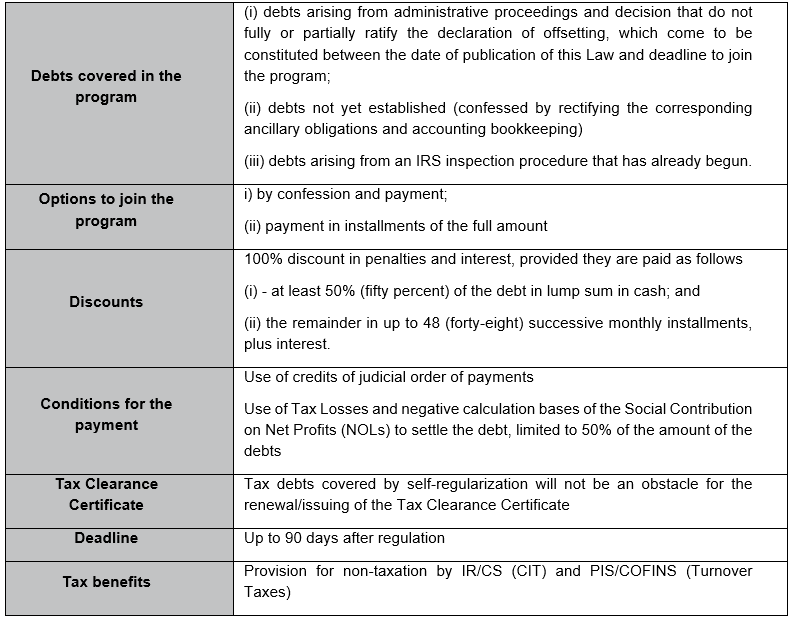

On November 30, 2023, Law 14,740/2023 was published, which provides for the incentivized self-regularization of taxes handled by the Brazilian Internal Revenue Service, with the waiver of interest and penalties. Taxpayers will have up to 90 (ninety) days after the law is regulated to join the program.

In more detail

The self-regularization program provides for the possibility of paying tax debts within the scope of the Brazilian Internal Revenue Service, the main points of which are discussed below:

We believe that the regulations will be published later this year, so we recommend that an assessment be made of potential debts that the company believes could be included in this program.